Ad Disclosure: This article contains references to products from our partners. We may receive compensation if you apply or shop through links in our content. This compensation may impact how and where products appear on this site. You help support CreditDonkey by using our links.

You can easily access your Chase bank statement online. Find out how to view your past activity at any time.

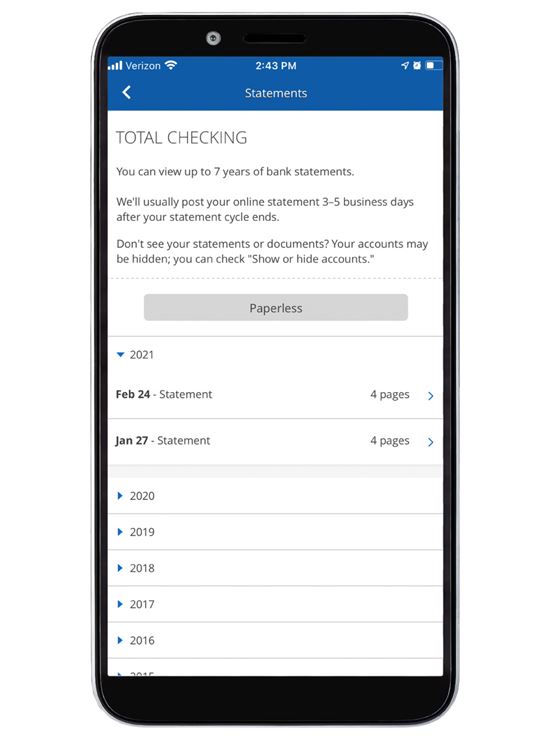

Just signed up for Chase paperless statements? You can now view up to 7 years of statements without hassling with physical mail. Viewing your Chase statement online is a very quick and simple process. To get started, follow the steps below.

|

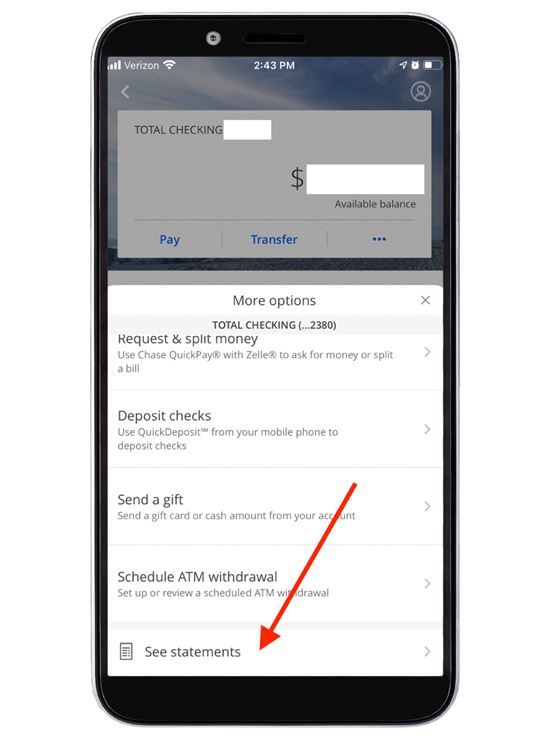

| Screenshot of Chase |

|

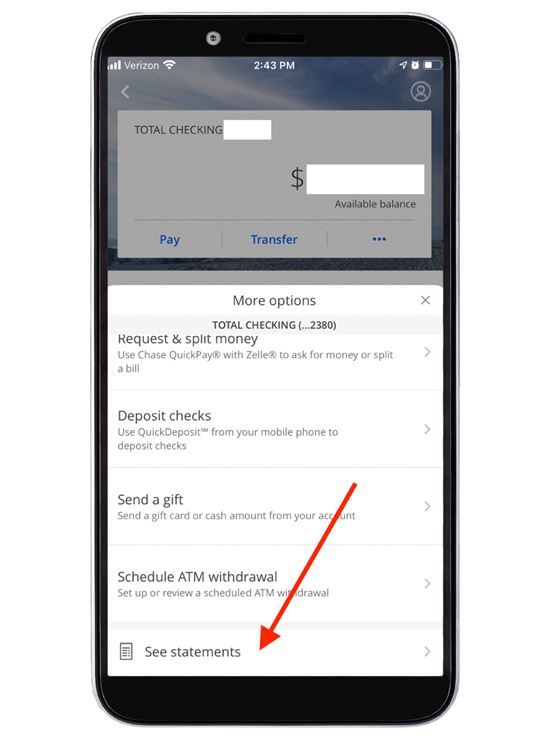

| Screenshot of Chase |

Enrolling in Chase Paperless Statements is super easy, can be done online, and takes just a couple minutes. Follow these steps to stop your paper statements with Chase and enroll in paperless.

Can I print my Chase statement online? You can print any Chase statement that is available online. To do so, click the "Open" icon next to your statement (it looks like a piece of paper) and open the statement as a PDF. Then, print directly from your browser, which you can do by clicking the printer icon in the upper right-hand corner.

You receive statements when you open a Chase checking/savings account or credit card. If you don't have a Chase account yet, check out their bank promotions and coupon codes.

Chase Bank lets you easily view your statements online and from the mobile app. To perform even more financial tasks on-the-go, download the Chase Mobile App. You can locate ATMs/physical branches, deposits checks, transfer money and more. In order to access monthly statements, you need a Chase checking account. If you don't have a checking account with Chase yet, take a peek at their current promotions and coupon codes. As you manage your finances more effectively, you can earn a bonus along the way.

To qualify for Bonus: Apply for your first Discover Online Savings Account, enter Offer Code CY624 at application, deposit into your Account a total of at least $15,000 to earn a $150 Bonus or deposit a total of at least $25,000 to earn a $200 Bonus. Qualifying deposit(s) may consist of multiple deposits and must post to Account within 45 days of account open date. Maximum bonus eligibility is $200. What to know: Offer not valid for existing or prior Discover savings customers, including co-branded, or affinity accounts. Eligibility is based on primary account owner. Account must be open when bonus is credited. Bonus will be credited to the account within 60 days of the account qualifying for the bonus. Bonus is subject to tax reporting. Offer ends 09/12/2024, 11:59 PM ET. Offer may be modified or withdrawn without notice. See advertiser website for full details.

Member FDICAmber Kong is a content specialist at CreditDonkey, a bank comparison and reviews website. Write to Amber Kong at amber.kong@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts. Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

| Build Wealth |

|---|

About CreditDonkey

CreditDonkey is a bank comparison website. We publish data-driven analysis to help you save money & make savvy decisions.

Editorial Note: Any opinions, analyses, reviews or recommendations expressed on this page are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

†Advertiser Disclosure: Many of the offers that appear on this site are from companies from which CreditDonkey receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). CreditDonkey does not include all companies or all offers that may be available in the marketplace.

*See the card issuer's online application for details about terms and conditions. Reasonable efforts are made to maintain accurate information. However, all information is presented without warranty. When you click on the "Apply Now" button you can review the terms and conditions on the card issuer's website.

CreditDonkey does not know your individual circumstances and provides information for general educational purposes only. CreditDonkey is not a substitute for, and should not be used as, professional legal, credit or financial advice. You should consult your own professional advisors for such advice.

(888) 483-4925 | 680 East Colorado Blvd, 2nd Floor | Pasadena, CA 91101

© 2024 CreditDonkey Inc. All Rights Reserved.