Invoices stand the test of time. Way back before indoor plumbing, paper, or even the alphabet was invented, humans were sending each other invoices to keep track of their accounts.

These ancient cuneiform tablets don’t bear much resemblance to the invoices we have today, with logos and account numbers, but the same information is conveyed.

In this post, we’ll explore the purpose of invoices for business and provide an example of a standard invoice. You can also take a look at our invoice generator, which will help you set up invoices for your small business.

An invoice is a document used to itemise and record a transaction between a Supplier and a buyer. A simple invoice definition is that it’s a commercial document issued by a seller telling the customer what they purchased and what they need to pay.

Typically, a business sends an invoice to a client after they deliver the product or service. The invoice tells the buyer how much they owe the seller and sets up payment terms for the transaction.

Businesses can use invoices to track what customers owe in total as a way to monitor cash flow.

Invoices can help companies receive payment in full and on time. And they serve as records of sale and provide a way to track:

Additionally, invoices can help you protect your company in the event of an audit, as they help to create a paper trail. Detailed invoices will show the taxation department in your country exactly where your money came from should they question your tax returns.

When selling products or services, enter the invoice amount owed as accounts payable on the buyer’s end. For a business, the invoice is in accounts receivable.

While similar information is included in sales receipts and invoices, they are not the same . An invoice is issued to collect payments from customers, and a sales receipt documents proof of payment that a customer has made to a seller. Receipts are used as documentation to confirm that a customer has received the goods or services they paid for, and as a record that the business has been paid.

Both invoices and bills are records of a sale that indicate how much a customer owes a seller, and both are issued before a customer has made payment for the transaction. However, there are some differences between each term.

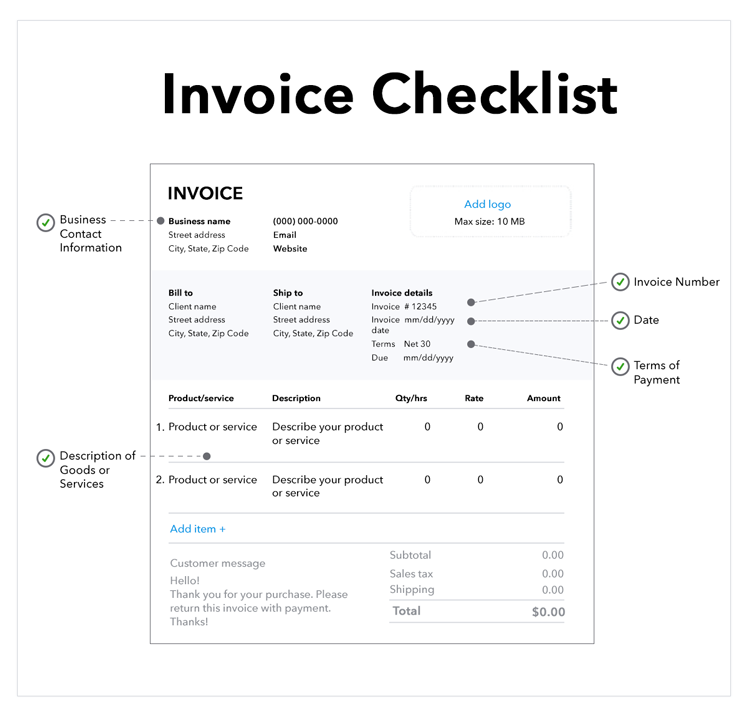

Invoices aren’t necessarily standardised, and your country may have its own local requirements for invoice submissions. Invoices can vary by supplier or contractor, and you must double-check your local government’s rules in order to properly submit them. However, all invoices should include the following five components:

An invoice number should be assigned to each invoice you issue. This reference number establishes a paper trail of information for you and your customers’ accounting records. Assign invoice numbers sequentially so that the number on each new invoice is higher than the last. Using electronic invoicing makes this process simple.

Invoices aren’t necessarily due immediately when customers receive them. You may choose to set invoice payment terms of up to three months to give your customers the flexibility to manage their cash.

The invoice date indicates the time and date the Supplier officially records the transaction and bills the client. The invoice date is a crucial piece of information, as it dictates the payment due date and credit duration. Generally, the due date is 30 days following the invoice date. But this can vary based on a company’s needs and the agreement with the client or buyer.

Within an invoice, you must provide your business contact information, including name, address, phone number, and email address, along with your client or buyer’s information.

You should enter every product or service you provide as a line item on your invoices. Include the price and quantity for each line item. At the bottom of the invoice, add up all of the line items, and apply any tax charges.

Here’s a quick checklist of what to include when listing products or services provided:

To increase the likelihood of receiving invoice payments on time, provide clear details about payment expectations . Your payment terms should specify the amount of time the buyer has to pay for the agreed-upon purchase.

Choose invoicing terms that encourage early or advance payment to maximise your cash position and the likelihood of getting paid . You may choose to collect half of the payment upfront or partial payments over time or require immediate payment upon completion.

When setting payment terms, consider how to handle late payments . You might also consider a customer’s credit history when developing payment terms, particularly for large sales.

Then you can decide how long your customer needs to settle an invoice. Net 30 days (or “N/30″) is one of the most common terms of payment. It means that a buyer must settle their account within 30 days of the invoice date.

It’s important to remember that 30 days is not equivalent to one month. If your invoice is dated March 9, clients are responsible for submitting payment on or before April 8. Businesses may also set invoice terms to Net 60 or even Net 90, depending on their preferences and needs.

There are many different invoice payment terms, so it’s important to choose the right payment terms for your business. The chart below shows some of the common payment terms you may choose.